When it comes to money, even the smallest efforts can add up to significant savings! Today, we’ll be diving into the idea of ‘little money’ saving methods — those small yet impactful ways to save and earn that can easily add up to save $1000 in a year.

I definitely understand that dealing with money can feel overwhelming, especially if you’re an overthinker and don’t really know where to begin. To that end, this post is not about making major financial changes.

Instead, we’ll discuss a few creative and practical money stash ideas meant to show you how to make progress without changing your budget and inspire you to start taking action to improve your money situation. (There’s even a free tracking spreadsheet download!)

Get ready to discover the power of small steps in reaching your financial goals and watch your savings soar!

This post may contain affiliate links. If you choose to purchase through an affiliate link, I may receive a small commission at no additional cost to you. You can see my full disclaimer here.

What Is The ‘Little Money’ Saving Method?

Many years ago, I belonged to a frugal online forum where we often discussed something we called ‘little money’ savings. Many of us were on a very tight budget, and it really felt like there was no way to reduce our regular expenses any further.

These small money saving ideas were ways to build up a money stash for an emergency fund or put extra toward paying off debt — all without changing the budget.

I discovered that I could easily set aside at least $1000 every year without even noticing or really making much extra effort in my daily activities. With the increasing number of online opportunities now available to help you save and earn, the possibilities are even greater!

Some of these ideas require effort on your part. I understand that some of you will say, ‘It’s not worth my time. I can work one extra hour at my job and earn more than I ever would doing something like returning cans or hanging laundry.’ Sure, I get that.

But for those of you who have some time and aren’t interested in a side hustle or overtime at a regular job, here are some small, simple ways to begin working toward your financial goals.

Even if you do have a good regular income, some of these ideas are just plain smart. I’ve been doing some of them for over 20 years — and yes, they still help me stash away over $1000 per year.

Important: Set a Goal for Your Money

Speaking of financial goals, you will never get anywhere if you don’t have one. You might do a few of these things for a few weeks, but then you will blow what you’ve saved on going out to eat. Don’t do that.

Set a specific goal in writing for exactly what you want to do with this money. Some money stash ideas might include:

- Paying down debt

- Stashing cash in an emergency fund (you need one)

- Saving for an event like a special party — graduation, anniversary trip, etc.

- Saving for home improvements or decorating

- An annual gift fund (yep, you need one of those too)

If you feel like you need to start somewhere to find extra money for your goals, then set your mind to trying at least one of these suggestions. They won’t all work for everyone, but you should be able to find something here that sparks the thought, ‘Sure, I can do that!’

7 Little Money Ways to Earn and Save $1000 In A Year

This list of ‘little money’ savings ideas is by no means EVERYTHING you could try. But it is a list of things I have personally done and found success with.

Use the ideas that work for you, discard what doesn’t. Once you’ve tried these, get creative to think of your own unique ways to save money that fit with your life.

1. Checkbook rounding

This is my favorite way to stash money in savings! Round every deposit down to the nearest $5 and every expenditure up to the nearest $5. It takes almost no time and for me it adds up to about $25-$45 every month that goes straight into savings. (Your amount will vary.)

I spend about 5 minutes a month with a calculator and the checkbook. This includes the time online to transfer the money from checking to savings. I still like to use an old-style paper checkbook for tracking my account, but you could easily do the same by pulling up your transaction report online and doing the rounding by hand.

If you use a debit card for regular purchases, your savings could be significant.

Yes, there are some online programs that claim to do this or something similar for you. Acorns and Digit are two that come to mind. (I have NOT personally used these programs.)

But I’m old-school. I like to keep control of my money and I don’t like to pay fees. If you are interested in something automated, check them out. You need to do what works for you.

2. Picking up and returning cans

With Michigan’s 10¢ deposit law, cans and bottles are pretty valuable. We live on country roads where a lot of people toss empty cans out of their car windows. A short walk can yield quite a few cans.

There are also a lot of people who simply hate returning cans and just don’t do it. Our neighbor from years ago was one of those people, and our boys used to benefit greatly from this. Seriously, they were given hundreds’ of dollars worth of cans over the years.

If you live in a bottle-deposit state and have friends who hate returning cans, offer to take them. You’ll both benefit — they’ll be happy to have one less chore, and you’ll make some money.

3. Hanging laundry

Admittedly, I don’t do this one much these days. We have a propane dryer, and most of the time it doesn’t cost much to run. Plus, I found that even with using good detergent, our towels and clothes would get stinky after a few times of line-drying. It was likely due to poor water quality, but it was still an issue.

Some people do like hanging laundry, loving the decreased wear and tear on their clothing and the positivity of using fewer resources.

If you’re one of those people, kudos to you! *high five* I’m not, and using my dryer is something I am crazy-happy to do these days. But when I did hang laundry, I paid myself .25/load, which came out to about $10/month.

4. Rolling coins

When you pay for purchases with cash, never use your coins, only paper money. Stash those coins and roll them when you have enough.

My bank gives out free coin roll papers on request. I’ve heard some banks charge you a fee to deposit rolled coins, which is ridiculous. If your bank does this, find a new one. Even better, find a bank where you can just cash in your loose coins (at no cost) and don’t even have to wrap them!

I have always avoided Coinstar kiosks because of the fee to get cash, but I believe they *might* now have some gift card options that eliminate the fee. This could be worth checking out if you were going to shop at the brands offered. Then, instead of spending that money out of your checking account, transfer it to your ‘little money’ savings.

These days I don’t need to shop very often. But back when I was making the effort to always pay cash everywhere I went, my rolled coin savings averaged about $60 per year. Nope, not a lot. But it was nice to see it going into savings a chunk at a time rather than disappearing throughout the year.

To take it a step further, you could save all of your $1 — maybe even $5 — bills. That really ramps up the savings rate!

5. Coupon savings

When you use a coupon for something that you would buy anyway, transfer the money you would have spent into savings.

Do not fall into the trap of using coupons on things you would never normally purchase and then pretend you are saving money.

If you don’t want to think about using coupons, shop at Aldi. They have great prices and don’t accept coupons. Easy!

6. Shopping apps

Maybe you’re not into using physical coupons. Neither am I — and I used to be a coupon queen! You can read more about why I no longer coupon shop or stockpile HERE.

Instead, shopping apps may be more up your alley. What I like about these is that it’s easy to see exactly how much you’ve saved, and then you can transfer that chunk right into savings.

I think shopping apps are most effective if you shop often. Since I really only shop once a month — and even then it’s mostly at Aldi — I don’t save or ‘earn’ that much. These days, it’s probably about $10/month through the Meijer mperks app. (Remember, this is all about how those small amounts of money add up!)

A few apps to try:

- Ibotta

- Checkout 51

- ReceiptHog

- Shopmium (formerly SavingStar)

- Rakuten (formerly Ebates)

7. Rewards credit card

Not everyone uses credit cards, but we do have one. It’s a rewards card that gives us a percentage back on all of our purchases. We use it for gas, groceries, recurring bill payments, and planned purchases.

Even though we are fairly conservative shoppers, we still earn several hundred dollars a year from our card. Yep, it’s a big chunk of that ‘little money’ savings method. And while it does work, it comes with some caveats…

If you’ve read my post on taking one main step to reach your financial goals, then you know I’m a huge fan of the financial Baby Steps presented by Dave Ramsey. Trust me, I know this point goes against his recommendations — but that’s why personal finance is personal.

We don’t shop often, we always pay off the card every month, and there is no annual fee, so it works for us. If you or your partner have a spending issue, then I definitely do not recommend this strategy.

Track the ‘Little Money’ Savings

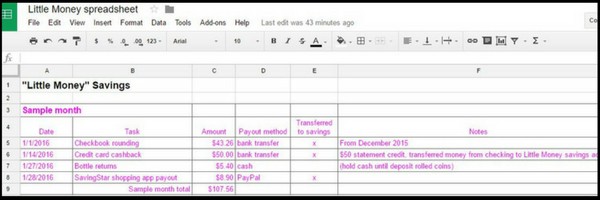

To make your ‘little money’ efforts worthwhile, you need to track the money. One way is to write everything down in a notebook. Another — my personal choice — is to use a spreadsheet page.

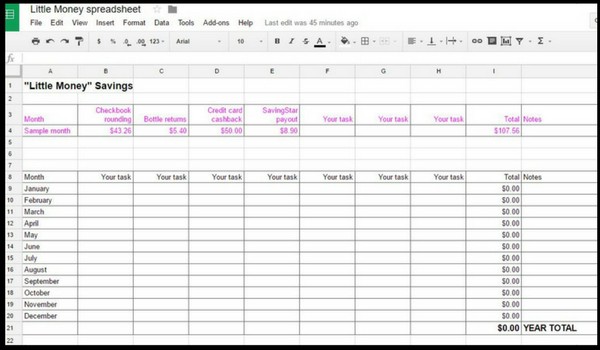

I made a simple spreadsheet in Google Sheets for you — click HERE to access it. Then, click ‘File > Make a copy’ to save a copy for yourself. From there you can edit and personalize the spreadsheet to fit your own style.

The first page is for people who like to track every single thing and make notes. More scrolling, but more detailed.

The second page is for people who only want to do a few things and see how they are progressing for the year at a glance.

Even if you send the money toward debt payoff every month, tracking the amounts will help motivate you when you can see the progress you’re making.

Keep the Money Separate

If your goal is savings, the best way to keep your money accessible but separate is to create an online account. One of my favorites is Capital One, but even your local credit union may work just fine.

The main thing you want is the ability to set up multiple savings accounts for different things — emergency fund, little money savings, vehicle savings, etc. You also want a bank where any information you need about your account is easy for you to find when you need it — like your full account numbers, routing numbers for moving your money, etc.

More Resources For Simple Money Management

Weekly and Monthly Budget Spreadsheet for Google Sheets

The Total Money Makeover: A Proven Plan for Financial Fitness – Dave Ramsey

Editable Finance Planner Bundle

7 Money Rules for Life®: How to Take Control of Your Financial Future – Mary Hunt

Set that financial goal and then work for it! Don’t ever think that Little Money amounts are too small to make a difference in your financial picture. It all starts with attitude… and before you know it, you’ll be able to save $1000 in a year and it will probably seem quite easy.

Pennies make dollars, and dollars make a difference… You’ve got this!

Did you enjoy this post? Know someone else who might like it? Please take a moment to share on Pinterest, Facebook, or your favorite social media… (Click the sharing buttons at the bottom of the post.) Thank you!

This blog post was updated on October 24, 2023.

These are wonderful tips!!

Totally pinning this and sharing with my husband. 🙂

Thank you!!

XO

Hi Dean! I’m glad you liked the tips! Let me know what your husband says. 😉 It’s always interesting to hear a man’s thoughts.

Lovely saving tips. I always line dry and love it. The sun sanitises clothes. Towels won’t smell if they are washed well with a little bicarb and thoroughly dried on the day that they are washed.

Kathleen

Bloggers Pit Stop

Well, I had to laugh a little bit when my dryer quit the day after I published this post! It’s back to hanging laundry until I have time to go buy another dryer. Baking soda definitely helps! Thanks, Kathleen!

Good points and a fee that I have not thought of before.

Hi Lynn! I’m glad you were able to find some new ideas! 🙂

I love to save change, my husband makes fun of me for it, but he isn’t laughing when I am putting 2-4 hundred dollars a year in our savings account!! Great post, Pinned it!

Hi Michele! It feels good to see how those small amounts add up, doesn’t it? Glad you liked the post and thanks for the Pin! 🙂

These are certainly good tips! I actually love hanging laundry and the freshness that it produces! 🙂

Hi Kendall! I’m glad you liked the tips! Enjoy your fresh laundry! 🙂

Love these tips! I think the one that has helped me the most is tracking my spending. In the world of debt/charge cards it is so easy to lose track of how much we spend.

Hi Melissa! Yes, tracking is so important! Thanks for visiting! 🙂

Hey! I love this post! Even though I am in England so many of the tips are transferable! I’ve tweeted it as I think so many people can benefit. And thanks to your reader about the bicarb tip. Do I just put some in the washing machine? Wish you could find that out, lol.

But thanks for a great useful post

Hi Jo & Leisa! You can add 1/2-cup of baking soda directly to the washing machine when beginning the wash cycle. I actually find it less expensive to run my dryer than to use that much baking soda with every load, but I do use it when I’m doing a “refresh” of towels and washcloths. But I also use hot water when I do that, the baking soda MAY not be as effective in cooler water? I have a top-loader, not sure if it’s different for front-loaders.

About 40 years ago I decided to put aside the amount of money that I saved from using coupons. At that time some of the grocery stores had double coupons so the money added up. I saved enough money to pay for our one week vacation to Ocean Isle Beach, North Carolina, for our family of 5.

Visting from Sunday’s on Silverado – thanks for some really good ideas here! We’re on a fixed income and I want a new stove. I’ll be filling that jar this year!!

These are great tips. I really need to save more money in my emergency fund.

This post is one of my features for SSPS #286, thank you for sharing with us, we appreciate it!